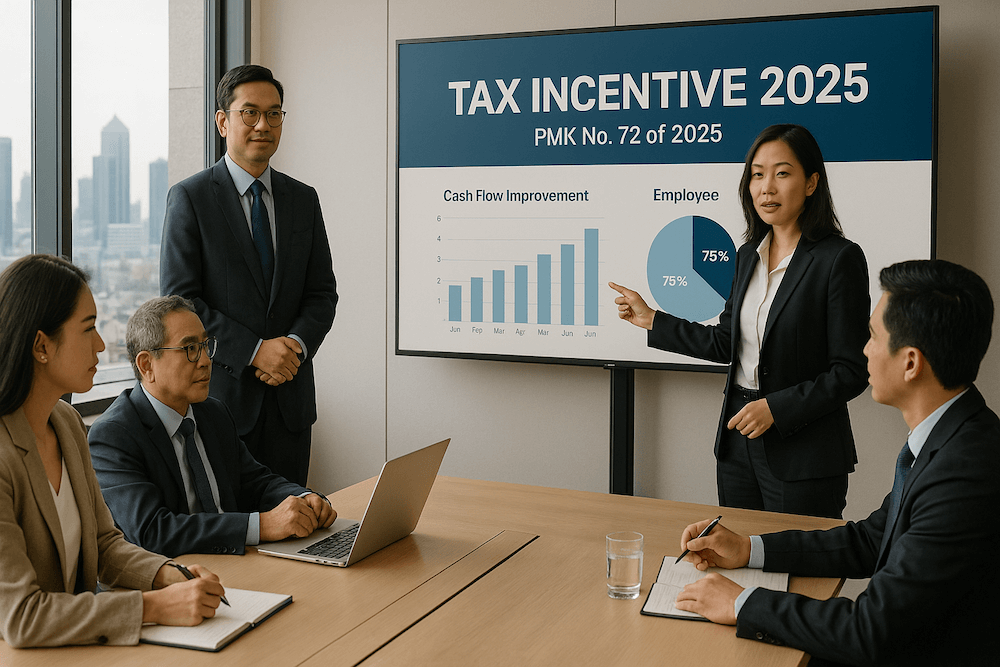

PMK No. 72 of 2025: Unlocking Strategic Tax Benefits for Business Owners

Content

In October 2025, the Indonesian Ministry of Finance issued Regulation No. 72 of 2025 (PMK 72/2025), expanding fiscal support to key industries under the Government-Borne Income Tax (PPh Article 21 DTP) program.

This regulation modifies PMK No. 10 of 2025 and now includes not only manufacturing industries—such as textiles, footwear, furniture, and leather goods—but also the tourism sector, one of Indonesia’s core economic drivers.

For business owners, this policy represents more than just a temporary tax break. It’s a strategic opportunity to strengthen financial resilience, improve employee satisfaction, and enhance competitiveness in an increasingly challenging economic landscape.

What PMK 72/2025 Offers to Businesses

PMK 72/2025 allows eligible employers to transfer the burden of employee income tax (PPh 21) to the government for a specific period:

- January–December 2025 for industrial sectors.

- October–December 2025 for the tourism sector.

Employers pay employees their full gross income without deducting PPh 21, and the government effectively covers the tax. This incentive is crucial for business sustainability as it offers both immediate direct cash-flow relief and longer-term indirect productivity gains.

The Business Advantages of PMK 72/2025

1. Improved Cash Flow and Liquidity

By eliminating the need to remit PPh 21 for eligible employees, companies can retain more working capital each month. This liquidity advantage can be reallocated toward:

- Purchasing raw materials or spare parts.

- Expanding production capacity.

- Covering operational costs during low-demand periods.

For SMEs and exporters in particular, improved liquidity directly translates into better business continuity and operational stability.

2. Payroll Cost Optimization

The regulation allows business owners to maintain or even increase employees’ take-home pay without raising gross wages.

This effectively acts as a wage subsidy—funded by the government—but delivered through the employer’s payroll system.

It also helps businesses avoid wage disputes during uncertain economic cycles by offering employees higher net income at no additional cost to the company.

3. Strengthened Employee Morale and Retention

When employees receive their full salary without tax deductions, morale and loyalty naturally improve.

For industries with high turnover (e.g., textiles, hospitality), this can significantly reduce recruitment and training costs.

Moreover, it allows employers to differentiate themselves as supportive and compliant organizations, strengthening internal culture and public image.

4. Competitive Advantage in Recovery and Growth

Industries covered under PMK 72/2025—such as textiles, footwear, and tourism—are export- and labor-intensive. By adopting the incentive early, business owners can:

- Lower unit costs per product or service.

- Offer more competitive pricing domestically and internationally.

- Free up capital for innovation, marketing, and market expansion.

Businesses that integrate this fiscal relief into their broader strategy can accelerate growth ahead of competitors that delay compliance or fail to utilize the incentive.

5. Enhanced Compliance Reputation

Proper implementation of PMK 72/2025 demonstrates regulatory compliance and maturity, which are qualities highly regarded by government agencies, auditors, and investors. Companies that align early with government programs tend to:

- Receive smoother approval processes in future incentive schemes.

- Build credibility with financial institutions and partners.

- Reduce audit risks associated with improper tax handling.

In the long run, proactive compliance contributes to corporate resilience and stakeholder trust.

6. Long-Term Strategic Benefit

Although PMK 72/2025 is a time-limited measure, the experience of implementing structured government incentives can strengthen a company’s internal tax governance system.

Businesses that document, monitor, and report under this framework gain:

- Better understanding of fiscal mechanisms.

- Readiness for future government-linked sustainability or innovation incentives.

- A stronger financial reporting culture that supports scalability and investment readiness.

Example of Business Impact

| Aspect | Without PMK 72/2025 | With PMK 72/2025 |

|---|---|---|

| Employee Take-Home Pay | Deducted by PPh 21 (net lower) | Full salary received (tax borne by government) |

| Company Liquidity | Reduced due to monthly tax payments | Improved—funds retained for operations |

| Employee Morale | Neutral or low | Higher satisfaction and retention |

| Competitive Position | Standard pricing | Enhanced flexibility to adjust pricing or reinvest |

| Compliance Standing | Regular taxpayer | Recognized as participant in government incentive program |

Implementation Tips for Business Owners

To maximize benefits, business owners should:

- Verify eligibility using the correct KLU (Business Classification Code) registered with the Directorate General of Taxes (DGT).

- Prepare documentation: employee list, tax worksheets, and payroll evidence as required in Annexes A–C of PMK 72/2025.

- Update OSS-RBA and DGT data to avoid disqualification.

- Coordinate with tax consultants or in-house finance teams for compliance accuracy.

- Communicate transparently with employees about the incentive to build goodwill and trust.

PMK No. 72 of 2025 represents a strategic opportunity that extends beyond mere fiscal regulation. It allows Indonesian business owners to bolster their financial stability, improve employee engagement, and enhance their market competitiveness.

By adopting this incentive proactively and responsibly, companies can:

- Secure immediate cash-flow relief,

- Enhance workforce satisfaction, and

- Build a reputation of compliance and resilience aligned with Indonesia’s post-pandemic growth agenda.

For forward-looking business leaders who want to take advantage of PMK 72/2025 by saving on taxes, Business Hub Asia is ready to assist through our professional tax advisory service.

Michal is a CPA Australia-accredited entrepreneur with 15+ years of experience across Southeast Asia. Founder of Cekindo, now part of InCorp Group, he advises global firms on market entry, compliance, and expansion in Indonesia, Vietnam, and the Philippines.

Stay updated with market insights

Get in Touch With Our Team

Let us know how we can assist with your company formation or expansion.

Start Your SEA Market Entry with Confidence

Business Hub Asia is ready to help you navigate Indonesia, Vietnam, and Philippines regulations, from business licensing and product registration to workforce management. With an efficient, accurate, and business-focused approach.

Disclaimer

The content provided on this website is published by PT. Bisnis Hub Asia (“we“, or “us“) for general informational purposes only. While every effort is made to ensure the accuracy and timeliness of the information presented, we make no representations or warranties, express or implied, as to the completeness, accuracy, reliability, suitability, or availability of any content, products, or services described on this website. Any reliance placed on such information is strictly at the user’s own risk.

We are a private, independent entity and are not affiliated with, authorized by, or acting on behalf of the Government of the Republic of Indonesia, its ministries, agencies, or any officially appointed representatives. This website does not provide, offer, or promote any official government documents or services, including but not limited to:

-

Business identification numbers (Nomor Induk Berusaha – NIB);

-

Tax refunds or rebates;

-

Stay Permit or electronic travel authorizations;

-

Passports or other immigration-related documents.

Any references to such services are provided solely for general informational purposes and should not be construed as an offer or facilitation of official services.

We are committed to ensuring the protection of your personal data in accordance with Law No. 27 of 2022 on Personal Data Protection. Any personal information collected through this website will be processed for the purposes clearly stated in our [Privacy Statement]. We do not sell or misuse personal data under any circumstances.

By accessing and using this website, you acknowledge and agree to the terms set out in this Disclaimer. You further agree to use this website and the information provided responsibly and in compliance with applicable laws and regulations.

For further information or questions regarding this Disclaimer, please contact us via the channels provided on our Contact page.

You May Also Like

Stay informed with our latest insights, guides, and articles on doing business in Southeast Asia.

Export Import, News & Updates, Tax & Accounting

Maximizing Import Duty Exemptions Under PMK No. 108 Tahun 2025

Arif Hidayat • 5 minutes read

News & Updates, Tax & Accounting

Why PMK 111 2025 Redefines the SP2DK Regulation for Businesses

Nurmia Dwi Agustina, S.E., MBA • 4 minutes read

News & Updates, Tax & Accounting

PMK 105 of 2025 Indonesia: A Strategic Guide to the 2026 Government-Borne PPh 21 Incentive

Nurmia Dwi Agustina, S.E., MBA • 4 minutes read